extended child tax credit calculator

Have been a US. How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience.

Child Care Tax Savings 2021 Curious And Calculated

Parents with higher incomes also have two phase-out schemes to worry about for 2021.

. Explore Our Image Of Monthly Spending Budget Template For Free Budget Template Budgeting. If your MAGI is over 75000. The first one applies to the.

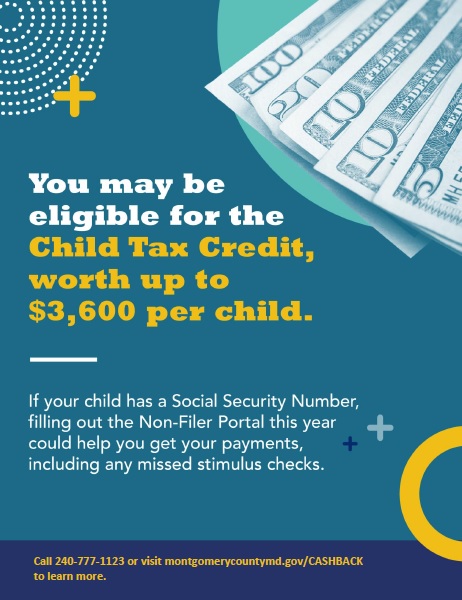

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040. The American Rescue Plan Act of 2021 has upped the child tax credit substantially as high as 3600 per child ages 5 and under for qualifying people.

Partial Expanded Child Tax Credit. In detail the latest child tax credit scheme allows each family to claim up to 3600 for every child below the age of 6 and up to 3000 for every child below the age of 18. To qualify a child must have been under age 17 ie 16 years old or younger at the end of the tax year for which you claim the credit2.

You will need to have. The funds are available for children from 6 to 17 years old and cost 41 per month. Extended child tax credit calculator Sunday July 10 2022 Edit.

Here is some important information to understand about this years Child Tax Credit. For married couples and joint filers the credit will dip. If your MAGI is 150000 or under you will receive 3600 per child under 6 and 3000 per child age 6-17.

The Child Tax Credit will begin to be reduced below 2000 per child if an individual reports an income of 200000. One of the measures in the package was an expanded Child. Tax Changes and Key Amounts for the 2022 Tax Year.

The 2021 New Expanded Child Tax Credit. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. The Child Tax Credit provides money to support American families.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Extended child tax credit calculator Saturday July 30 2022 Edit. The maximum child tax credit amount will decrease in 2022.

Our child tax credit calculator will help you estimate your. Under the American Rescue Plan Act ARPA of 2021 allowable expenses have increased from. In 2022 US expats are eligible to receive between 1400 up to 3600 per qualifying child on their 2021 US Tax Return.

The child and dependent care tax credit helps working parents afford the cost of childcare. 112500 if you are filing. The Child Tax Credit income limits are as follows.

In March 2021 President Biden passed the American Rescue Plan stimulus packages.

Expired 2021 Child Tax Credit Cut Child Poverty Nearly In Half Ct News Junkie

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

6 Things Parents Should Know About The New Child Tax Credit According To A Tax Expert Good Morning America

Child Tax Credit And Earned Income Tax Credit Benefit Calculator Community Change Is A National Organization That Builds The Power Of Low Income People Especially People Of Color To Fight For A

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

The Child Tax Credit Research Analysis Learn More About The Ctc

Federal Tax Credits You May Qualify For On Your Tax Return

About The 2021 Expanded Child Tax Credit Payment Program

I Have Shared Custody Of My Child Should I Get Monthly Child Tax Credit Payments Kiplinger

Parents Guide To The Child Tax Credit Nextadvisor With Time

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

2021 Child Tax Credit Payment Calculator Smartasset

2021 Child Tax Credit Calculator Internal Revenue Code Simplified

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Child Tax Credit Health And Human Services Montgomery County

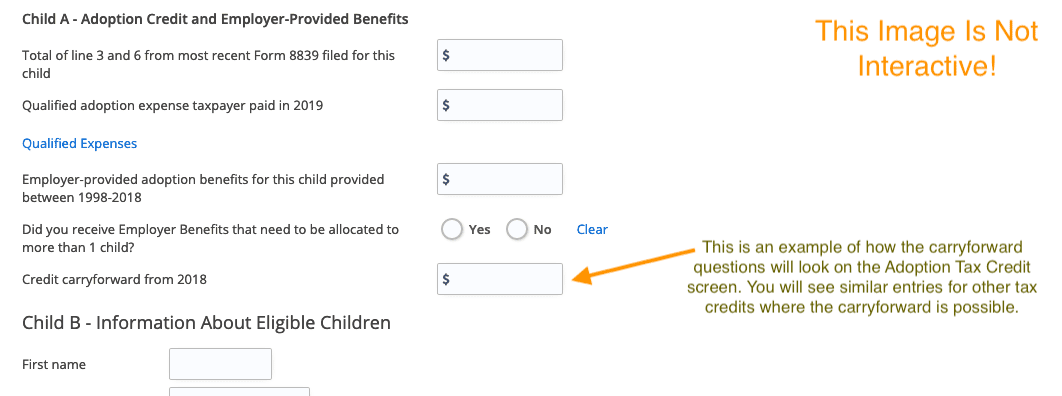

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back